Debt & Derangement

A monetary explanation for our current malaise.

By JOHN LEAKE

At a family dinner this evening, my youngest brother opined that the gamut of dangerous, nonsensical, and fraudulent activity we see in public affairs would have been inconceivable without the stupendous increase of the money supply since the Financial Crisis of 2008.

If NO public funds were available through endless bailouts, crisis countermeasures, extravagant military adventures, artificially low interest rates, “quantitative easing,” subsidies for silly social and educational programs, sweetheart “public-private partnerships,” and lobbyist-driven investment in industries that could never stand on their own in a free market, we would have to focus our energies on productive enterprise, and would have no time for dangerous nonsense. The need to earn a living would force us to make difficult, adult decisions instead of avoiding them and instead indulging in drivel.

By creating and spending endless amounts of money, the U.S. government and its Federal Reserve enable our politicians and people to think and feel like a spoiled trust funder with a cocaine habit. As a result of the constant bailouts, he is able to avoid the consequences of his wasteful, destructive conduct.

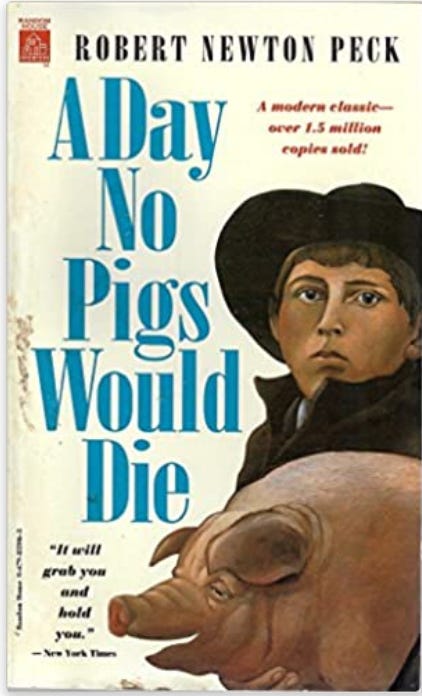

Such a trust funder is the opposite of the protagonist in the coming of age novel, A Day No Pigs Would Die, by Robert Newton Peck, in which a Vermont farm boy experiences the terrible consequences of an exceptionally long and cold winter. In the heartbreaking, climactic scene, he must confront a necessity so harsh that it eliminates all other considerations and attachments.

As dinner concluded, my brother asked me if anyone had ever drawn the connection between debt-fueled prosperity/excess consumption and widespread lack of reason in public affairs. I thought about it, and the man who came to mind was the Austrian economist and historian, Ludwig von Mises, who wrote about what he called malinvestment. Googling the term yielded this gem:

The boom squanders through malinvestment scarce factors of production and reduces the stock available through overconsumption; its alleged blessings are paid for by impoverishment.

Though this statement is written in an economic idiom, something akin to it applies to the spiritual life of a nation, and may be rephrased as follows:

The [debt-driven] boom vitiates moral and intellectual vigor and reduces discernment of reality through the insulating effects of bailouts and subsidies; its immediate freedom from consequences is ultimately paid for with a catastrophe.

When we strip it right down without all the smoke and mirrors, it becomes a simple case of arithmetic - money is created into the economy when a loan is signed. The principle amount goes into the economy but the interest amount NEVER does. So imagine how much interest has to be paid back and how it is NEVER entered into the economy and you can see one heck of a doozy Ponzi scheme. And who gets all that interest? And for doing what? Mind you the interest and not just the principle come from thin air. Plus - the banks draw on your strawman estate the minute a loan is signed. So they get paid at least twice. All that for the hard task of making numbers appear on a screen.

I have to point out a flaw in your thinking in part of this post. Indeed, debt is the culprit for many of the issues we have.

But people and businesses are not to blame. Undoubtedly, someone can over-extend themselves along with any business, but they are usually constrained by the income they produce. No person can purchase a home beyond a set income level. Mortgage companies can loosen lending practices, but these a for personal loans, not government.

The Federal Reserves of the world certainly make horrible decisions at times. The ECB lowered rates to zero in 2016, for example. That was undoubtedly a bone-headed idea that we are paying for today. There is too a concerted effort to blame the federal reserve banks for all kinds of issues, and they seem to be the go-to guy to be kicked when financial crashes take place. They are not immune from blame and are not the source of the problem either. The Federal Reserves (and this is important) react to the government's failed policy. They don't create these policies; they try to manage around them.

The blame for our financial condition sits squarely on politicians' narrow and weak shoulders. Both political parties spend money far beyond our ability to pay it back; they always use the excuse that money borrowed today will be paid back by cheaper cash in the future. As if any of them intend on paying anything back. And for that matter, they never do; they have no intention whatsoever to pay any back., They kick the financial can down the road for the next Congress to deal with.

What happens almost every time a new budget is formed? The debt ceiling must be raised because politicians don't seem to understand a limit. They are experts at spending others' money and have no problem sending our hard-earned cash to hell-holes like Ukraine or other money pits.

The politician is our worst enemy.