By Peter A. McCullough, MD, MPH

For the first time in decades, US obesity rates are falling. Can utilization of glucagon-like peptides (GLP-1) drug claim credit?

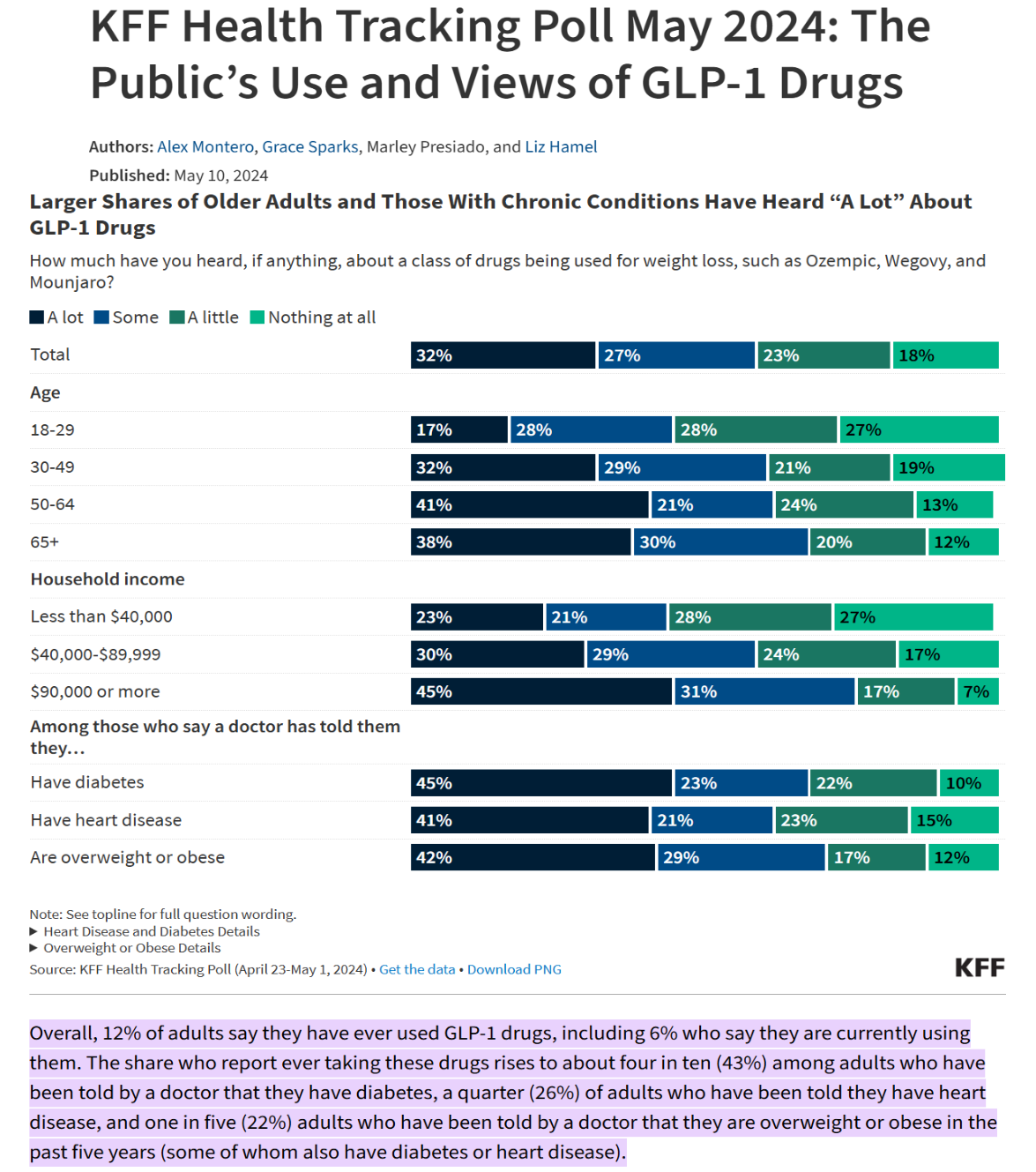

Approximately 12% of U.S. adults have used GLP-1 drugs at some point in their lives, with about 6% of adults currently taking them. Use has been rapidly increasing, especially among those using the medication for weight loss.

As of 2025, the U.S. market for Ozempic‑like drugs —that is, GLP‑1 receptor agonists and dual/triple incretin agonists used for diabetes and weight management—is enormous and expanding rapidly. Market value for these drugs is about $35 – 40 billion annually in U.S. sales (2024 data), projected > $50 billion by 2028. The leading products include Novo Nordisk’s Ozempic (semaglutide for type 2 diabetes), Wegovy (semaglutide for obesity), and Eli Lilly’s Mounjaro (tirzepatide) and Zepbound (weight‑loss version). The growth drivers include efficacy in weight reduction, diabetes control, cardiovascular benefits, and off‑label demand weight-related other clinical benefits. The constraint: supply shortages and high price (≈ $900–$1,350 per month list price). Nevertheless, the GLP‑1/incretin sector is now the fastest‑growing drug class in U.S. pharmaceutical history, centered on Ozempic‑type therapies.

Please enjoy this interview I had on NewsMax Health Report with Katrina Szish and her co-host on the GLP-1 RA drugs. Realize that MELT oral spray and DROP from The Wellness Company even further extend the GLP class to novel delivery, well tolerated products, that allow a less invasive more personalized approach for your weight loss journey.

Please subscribe to FOCAL POINTS as a paying ($5 monthly) or founder member so we can continue to bring you the truth.

Peter A. McCullough, MD, MPH

Chief Scientific Officer, The Wellness Company